There is more wealth out there than you think. But the government and media sometimes likes to trick us into believing there is not.

Government data says the median net worth in America is around $200,000. Meanwhile, the media keeps highlighting financial struggles, convincing us there’s a looming retirement crisis. But what gets overlooked is the tremendous wealth built over the past few decades—thanks to saving, investing, and riding the greatest bull market in history.

Enter: the rise of everyday middle-class multi-millionaires.

Wait, what? Middle class and multi-millionaire in the same sentence? Sounds like an oxymoron, right? But I assure you, they exist—and in far greater numbers than most people realize.

During the consulting promotion for my USA TODAY bestseller Millionaire Milestones, I had the privilege of speaking with many of them. Maybe I’ll get to speak to you too as the promotion is still going on until June 15. Details below.

Why “Middle Class” and “Multi-Millionaire” Can Coexist

The confusion comes from how we define wealth. Most people, especially those outside the personal finance community, equate wealth with income. The more you make, the richer you are, so they say.

I have indisputable proof: a 2025 Bloomberg article written by four journalists analyzed who qualifies for free college financial aid solely based on income. Not once did they mention assets or net worth in their evaluation. That blew my mind.

These were smart journalists from elite schools—Texas, Duke, USC, and Columbia—writing for a major publication. There’s no way I, or my children, could get into any of these schools. Yet somehow, they missed a fundamental component of what truly defines wealth.

When society talks about the “middle class,” it’s usually referring to income. In 2025, the median household income is around $80,000. One could define a middle-class income as anything +/- 50% of the median, or $40,000 – $120,000 in this case. For a family of three, the top of the middle class is about $188,400, inflation-adjusted. In contrast, the top 10% of earners in 2024 had to make at least $235,000 according to Pew Research.

In expensive cities like San Francisco or New York, a family of four might need $300,000–$350,000 just to feel middle class. People balk at that range, but the budget math doesn’t lie in my post. Thanks to inflation, life is only going to get more expensive over time.

Personal Finance Enthusiasts Think in Net Worth

Those of us who are passionate about financial independence don’t only define wealth by income—we prefer to define it by net worth (assets minus liabilities). Income takes effort and gets taxed heavily. But growing investments? That builds wealth quietly and consistently.

As we age and become less eager to trade time for money, net worth becomes the more meaningful metric. Our investments are what will generate enough passive income to live free. And with enough time, discipline, and smart investing, it’s very possible to become a middle-class multi-millionaire—even without ever earning a huge salary.

Let me share the story of one such person: Luis, a consulting client who has averaged under a $100,000 income in his 30+-year career. He enthusiastically encouraged me to share his financial profile to you to show what’s possible.

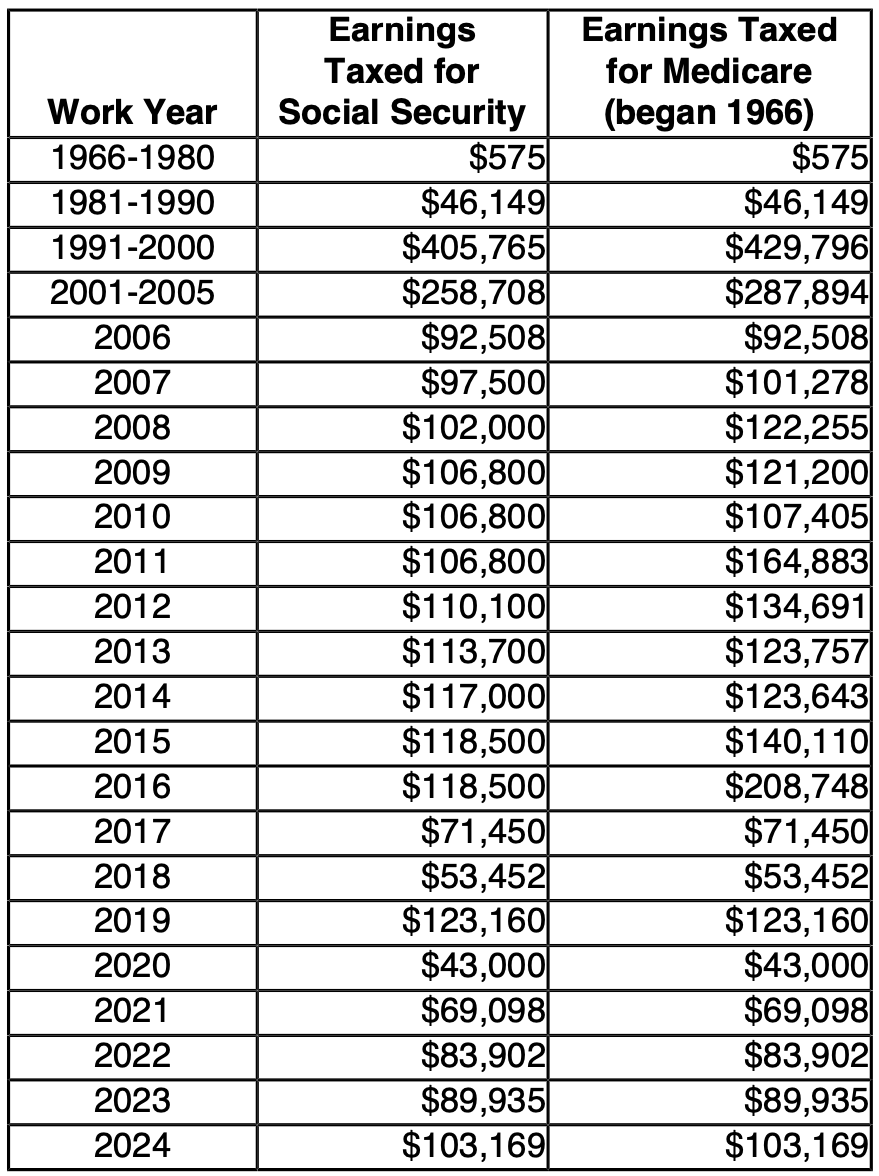

Here’s his Social Security statement that shows his historical earnings.

Net Worth Composition

Despite averaging less than $100,000 a year during his career, Luis is a multi-millionaire with a net worth of around $4.8 million! That’s at least $1 million more than I expected just by reviewing his Social Security statement.

His family’s total assets amount to $6,090,000, offset by a $1,439,000 mortgage. He also has about $235,000 set aside for his children’s college education.

As you can see from his net worth breakdown, real estate has been his primary driver of wealth. Luis bought properties once he started earning a steady income and held onto them. With real estate, much like stocks, the longer you hold, the more wealth you can generally build. He’s main goal is to pay down his low-interest mortgage.

Luis’s second major wealth engine has been his disciplined contributions to his retirement accounts, especially his Roth IRA. Unlike me, Luis was eligible to contribute to a Roth for many years thanks to his middle-class income. Now, he’ll be able to withdraw from it tax-free for the rest of his life.

| Ranch | $1,950,000 | 32% |

| Rental Property 1 = | $1,188,300 | 20% |

| Rental Property 2 = | $947,300 | 16% |

| Luis’ Roth IRA = | $1,386,237 | 23% |

| Luis’ IRA = | $257,920 | 4% |

| Wife’s Roth IRA = | $360,367 | 6% |

| Total Assets | $6,090,124 | 100% |

The Power of Being a Middle-Class Multi-Millionaire: Total Income Is Actually Much Greater

One final variable to highlight is Luis’s total income. While his base salary as a patent examiner is around $130,000, his actual income is significantly higher thanks to his additional income streams. No wonder he’s able to comfortably provide for six children—his total income is closer to $365,000.

| Yearly Income: | % | |

| US Patent & Trademark Office = | $130,000 | 36% |

| USMC Retirement = | $71,700 | 20% |

| VA Disability (tax free) = | $37,200 | 10% |

| Rental 1 = | $64,800 | 18% |

| Rental 2 = | $40,200 | 11% |

| Cell tower lease payment = | $10,800 | 3% |

| Ranch income (variable) = | $10,000 | 3% |

| Total Income = | $364,700 | 100% |

In addition to his day job, Luis earns substantial rental income from his properties, cell tower income from his farm, a pension from the United States Marine Corps, and VA disability benefits. Incredible!

Don’t underestimate the value of working for the government. A pension is far more valuable than it appears at first glance. For example, to generate $71,700 a year in passive income at a 4% yield, you’d need $1,792,500 in investments.

If you include the present value of his pension and other benefits, Luis’s net worth could be closer to $6.4 million rather than $4.8 million.

Long-Term Asset Ownership Is Key To Becoming A Multi-Millionaire

The rise of the middle-class millionaire will only continue as more people steadily invest over time. Luis is a great example. By serving his country and steadily building wealth for over 30 years, he’s now financially set for life.

His final financial goal is to pay off his mortgage. Together, we’ve created a game plan that uses income from his various sources—along with strategic Roth IRA withdrawals—to eliminate his remaining debt. Since he enjoys his job and plans to keep working for several more years, I have no doubt he’ll achieve this goal within the next decade.

With six children, Luis is also committed to helping them achieve financial independence. That deep sense of purpose and motivation is one of the greatest blessings of all.

If you want to become a multi-millionaire, you must consistently save and invest in assets that have historically appreciated over time. Real estate and stocks should be your bread and butter. And if you want, you can allocate up to 10% – 20% of your capital into alternative assets like venture capital, cryptocurrency, fine art, etc.

As Luis has shown, you don’t need a massive income—just the discipline to save and invest steadily. Over a 30+ year period, I firmly believe the vast majority of middle-class earners can achieve millionaire status in their lifetimes.

Readers, are you a middle-class multi-millionaire? If so, I’d love to hear how you were able to accumulate more wealth than the vast majority of the population. What were the key decisions or habits that made the biggest difference?

Also, what do you think is preventing more middle-class income earners from reaching multi-millionaire status? And why do you think society continues to focus so much on income instead of net worth when it comes to measuring financial success?

Resources to Build More Wealth

I’m offering 1-on-1 consulting at 41% off until June 15, 2025, before taking the summer off. You’ll also get 55 hard copies of my USA TODAY bestseller Millionaire Milestones to share. Just fill out the quick form at the bottom of my consulting page. I’ll get back to you within 24 hours.

Looking for a free tool to track your net worth and investments? Check out Empower. I’ve been using it since 2012 to monitor my finances and x-ray my portfolio for excessive fees. The more visibility you have into your money, the more effectively you can grow it.

Lastly, don’t miss my free weekly newsletter—trusted by 60,000+ readers—for real-time insights on investing, the economy, and my latest posts. My goal is to help you reach financial freedom sooner through hard-earned experience and actionable advice.